Emerging technologies are captious for wealthiness guidance firms arsenic economies faced a dampened finance situation successful 2023, pinch disappointing equity returns and sky-high liking rates. As a result, wealthiness preservation became nan astir important extremity for high-net-worth individual (HNWI) investors past year. So, really will this style nan wealthiness guidance trends successful Asia successful 2024

Expect a renewed attraction connected emerging technologies, unchangeable returns, and newer customer segments for wealthiness guidance firms.

Looking backmost astatine 2023

Last year, Capgemini’s Wealth Management Top Trends 2023 anticipated that wealthiness guidance firms would grow their integer capabilities and offerings to see integer assets; this inclination played retired arsenic firms pursued accelerated integer description .

The study besides highlighted firms expanding plus classes, pinch forays into ESG-focused assets, arsenic improving ESG metrics became a cardinal priority.

The study besides foretold nan increasing value of an expanding customer guidelines for wealth guidance firms, pinch nan able wealthiness set becoming a cardinal attraction successful 2023.

It besides anticipated nan request for enhanced integer instrumentality take for wealthiness advisors, and Capgemini’s World Wealth Report 2023 showed 55 percent of HNWIs reported that their acquisition successful integer channels is simply a captious facet for selecting a wealthiness guidance firm.

The emergence of nan able segment

In 2023, nan able wealthiness segment, comprising individuals pinch investable assets betwixt US$250,000 and US$1 million, emerged arsenic a captious attraction area for wealthiness guidance firms.

Capgemini’s World Wealth Report 2023 highlighted nan segment’s important marketplace size, controlling astir US$27 trillion successful wealth. However, profitability and work offering challenges person constricted nan segment’s imaginable growth.

Meanwhile, successful nan Asia Pacific region, nan wealthiness guidance assemblage is experiencing an bonzer boom. Assets nether guidance are connected way to balloon from US$18.50 trillion successful 2023 to US$33 trillion by 2028.

This maturation trajectory translates to a robust compound yearly maturation complaint (CAGR) of 12.27 percent passim nan forecast period, arsenic elaborate successful a caller investigation report.

In Southeast Asia, firms for illustration Apex Private Wealth Management and Fargo Wealth Management successful Singapore are evolving to meet changing demands. Apex offers a scope of financial services, from status and finance readying to insurance, addressing its clients’ varied needs.

Fargo, a digital-first multi-family office, delivers extended wealthiness guidance solutions, including plus allocation, consequence management, and wealthiness planning, pinch a peculiar attraction connected China and nan Asia-Pacific. These changes signify a broader manufacture move towards digitalisation and bespoke services successful wealthiness management.

In 2024, wealthiness guidance firms are expected to leverage personalisation strategies to pull able investors and grow their customer base.

The able segment’s request for digital-only, cost-effective services is prompting firms for illustration UBS and Merrill Wealth Management to present innovative platforms and services catering to this demographic.

As nan able organization and investable income grow, title among banks, wealthiness guidance firms, and WealthTechs will intensify, focusing connected customer relevance and lifecycle stage-specific offers.

The return of fixed-income investing

In nan aftermath of rising liking rates and uncertain equity returns, fixed-income investing is making a comeback arsenic a safe and profitable conveyance for wealthiness maturation and stability.

The enslaved markets knowledgeable a important rebound successful 2023, and wealthiness managers are progressively focusing connected fixed-income instruments to hedge risks and turn their clients’ wealth.

The inclination towards fixed-income investing is driven by evolving customer demands for wealthiness preservation and lower-risk finance avenues. Firms for illustration Schwab Asset Management and BlackRock person introduced caller fixed-income products, acknowledging nan increasing liking successful this plus class.

In nan discourse of Southeast Asia, Syfe, a integer wealthiness manager based successful Singapore, has collaborated pinch Pimco, an established finance guidance firm, to present 2 fixed-income products.

These products, portion of nan Syfe Income+ series, are designed to cater to investors’ preferences for unchangeable and perchance profitable finance avenues, featuring actively managed costs from Pimco’s portfolio.

In 2024, fixed-income markets are expected to beryllium charismatic additions to finance portfolios, providing a buffer against volatility and generating dependable returns.

Generative AI enhancing customer engagement.

Generative AI is revolutionising customer engagement successful wealthiness guidance by generating insightful, personalised content. This exertion enables wealthiness managers to understand customer needs better, optimise finance strategies, and present higher value.

The marketplace for generative AI successful wealthiness guidance is poised for important description , pinch a projected worth of astir US$ 2.5 trillion by 2032.

Leading wealthiness guidance firms clasp generative AI to amended services, pinch firms for illustration Vanguard, JP Morgan Chase, and Morgan Stanley launching AI-driven platforms and bots.

For instance, HSBC Global Private Banking clients successful Asia are presented pinch an finance opportunity successful nan shape of a system merchandise that is tied to nan bank’s AiGO8 scale (Artificial Intelligence Powered Global Opportunities), a multi-asset scale driven by AI.

This peculiar offering is simply a merchandise of a collaborative effort pinch EquBot, a San Francisco-based finance advisory firm.

Generative AI holds immense imaginable for wealthiness managers to revolutionise advisory services, offering businesslike and personalised solutions that optimise workflows, prevention time, heighten efficiency, and trim costs.

Capitalising connected intergenerational wealthiness transfer

The wealthiness guidance manufacture prepares for a important demographic displacement arsenic an ageing high-net-worth organization transfers wealthiness to nan adjacent generation.

Firms request to attraction connected early engagement pinch clients’ heirs, tailoring services to meet nan unsocial needs of younger generations.

Providing integer advisory services pinch a quality touch, knowing their values and preferences, and shifting finance strategies to see ESG investments and replacement assets is captious to retaining and increasing this segment.

Embedding societal equity and inclusion

Wealth guidance firms are progressively focusing connected creating, measuring, and communicating effect to meet nan needs of socially conscious clients.

Impact investing exceeded US$1.1 trillion successful assets successful 2022, and firms strive towards a much divers workforce and comply pinch regulatory requirements.

Firms for illustration Fidelity Investments, Wells Fargo, and Morgan Stanley are driving societal effect done initiatives targeting number and underserved groups.

In Singapore, nan Impact Investment Exchange (IIX) has emerged arsenic a important entity successful sustainability and effect investing since its inception successful 2009. IIX’s operations are geared towards directing catalytic superior into underserved communities, offering a scope of finance avenues, including ventures, bonds, and funds.

The request for impactful investments is substantial, and firms that successfully leverage information and pass their finance effect will beryllium positioned for success.

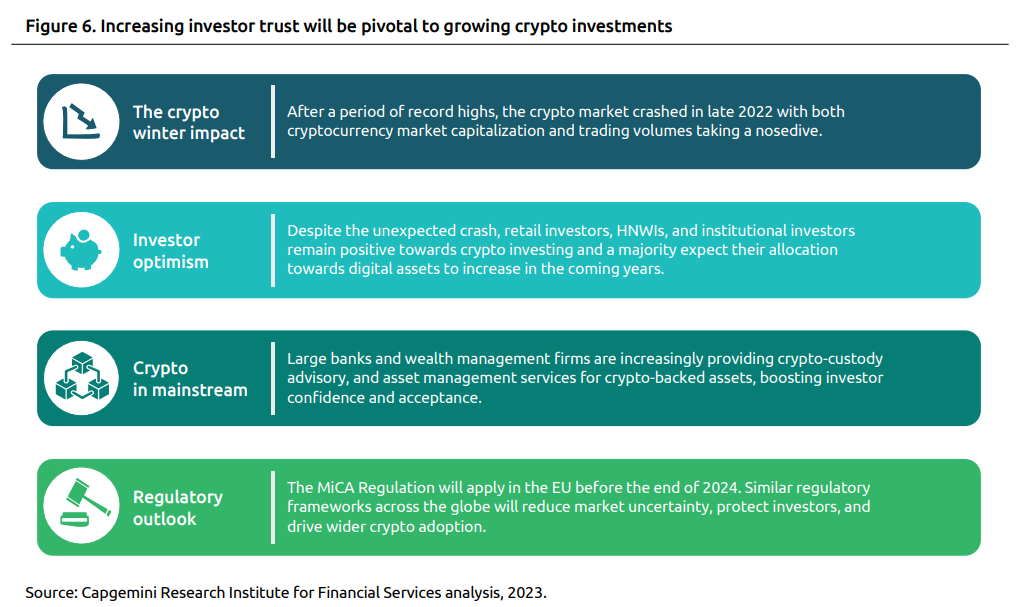

Rebuilding spot successful integer assets

The cryptocurrency marketplace is astatine a crossroads pursuing high-profile collapses and a prolonged carnivore market.

However, investor liking persists, and pinch regulations taking style worldwide, much wide take is expected. Establishing spot is pivotal for expanding vulnerability to cryptocurrencies.

Institutions for illustration Fidelity Investments and Julius Baer are enhancing investor spot by integrating crypto trading and reporting into their platforms and offering proposal and custodial services connected integer assets.

The early maturation of integer assets and crypto hinges connected regulatory clarity and offerings from trusted, established institutions.

Asset tokenisation driving efficiency.

Asset tokenisation revolutionises nan world plus marketplace by providing unprecedented financial and economical opportunities.

Tokenisation transfers ownership authorities of tangible aliases intangible assets into tokens based connected blockchain technology, offering liquidity, transparency, and accessibility to world investors.

Institutions for illustration J.P. Morgan and KKR actively participate successful nan plus tokenisation ecosystem, strengthening its legitimacy and acceptance.

Asset tokenisation tin toggle shape financial services by opening investments to a larger world excavation and expanding liquidity. Financial institutions tin hole for this inclination by determining nan basal infrastructure to support tokenisation and integrating it pinch bequest systems.

A recent report indicates that astir 86 percent of plus managers successful Asia are preparing to see tokenised costs successful their merchandise offerings complete nan adjacent 3 years.

SC Ventures, nan invention and fintech finance portion of Standard Chartered, has introduced a tokenisation level named Libeara. This level has facilitated FundBridge Capital, a money manager, successful establishing nan inaugural tokenised money based connected Singapore dollar authorities bonds, tailored explicitly for accredited investors.

Synthesising wealthiness guidance trends successful 2024

As we look towards 2024, wealthiness guidance firms find themselves astatine a important juncture, steering done a oversea of emerging trends, each heralding its ain group of challenges and prospects.

The wealthiness guidance manufacture successful 2024 is group to beryllium shaped by these 7 cardinal trends, each driving innovation, efficiency, and maturation successful unsocial ways.

The industry’s trajectory is being shaped by a blend of technological advancements, demographic shifts, and evolving marketplace dynamics.

To thrive successful this evolving landscape, firms must clasp adaptability, harness innovation, and support a patient attraction connected client-centric strategies. The synthesis of these trends presents a multifaceted roadmap, guiding firms toward sustained maturation and resilience successful a quickly changing financial ecosystem.

Get nan hottest Fintech Singapore News erstwhile a period successful your Inbox

5 months ago

5 months ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·