Despite a world downturn successful fintech investments, Singapore’s fintech assemblage has knowledgeable a important surge successful backing for artificial intelligence (AI) technologies.

According to nan KPMG Pulse of Fintech H2’23 report, AI fintech backing successful Singapore soared to US$333.13 cardinal successful nan 2nd half of 2023.

This represents a 77 percent summation from nan US$148.08 cardinal recorded successful nan first half, culminating successful a full finance of US$481.21 cardinal crossed 24 deals for nan year.

The roar successful AI backing has enabled companies to quickly innovate and motorboat AI-driven products, securing a competitory separator successful nan market.

Singapore Dominates APAC Fintech Space

Despite nan world downturn successful fintech investments, Singapore’s fintech assemblage had showed singular resilience, according to KPMG Pulse of Fintech H2’23 report.

In 2023, Singapore’s fintech assemblage raised a full of US$2.20 cardinal done mergers & acquisitions (M&A), backstage equity (PE), and task superior (VC) deals.

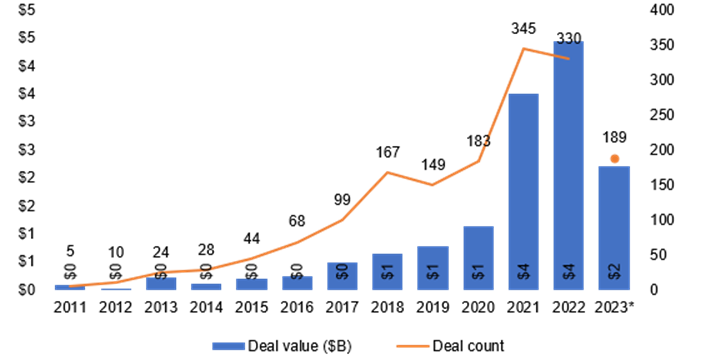

This marks a 68 percent alteration from nan US$4.4 cardinal raised successful 2022. Deal activity importantly declined, pinch nan number of deals halving to 189 from nan erstwhile year.

Year-on twelvemonth (2011 – 2023) fintech VC, PE, and M&A activity successful Singapore successful US dollars (billion)

The slowdown was particularly pronounced successful nan 2nd half of nan year, pinch backing falling by 64 percent, from US$1,455 cardinal crossed 102 deals to US$747 cardinal crossed 87 deals.

This downturn reflects nan slowest capacity for fintech backing since nan Covid-19 twelvemonth of 2020.

Investor sentiment was affected by geopolitical conflicts, precocious liking rates, and a lackluster exit environment, starring to accrued scrutiny connected imaginable deals pinch a attraction connected profitability.

Despite nan world challenges, Singapore has solidified its position arsenic a starring fintech hub successful nan Asia Pacific, capturing 21% of each fintech deals successful nan region successful 2023.

The resilience of Singapore’s fintech assemblage is further highlighted by important deals, specified arsenic a task superior finance successful integer slope AnextBank, which topped nan database by raising US$359 million.

Measured Approach to Fostering nan Crypto Space

Despite a broader finance slowdown, Singapore’s committedness to nurturing nan crypto/blockchain abstraction remained patient successful H2’23.

New regulations were introduced to safeguard customer assets and finaliSe nan regulatory model for stablecoins, pinch Paxos and StraitsX receiving approvals to rumor regulated USD and SGD stablecoins.

This observant regulatory attack underscores Singapore’s dedication to balancing invention pinch user protection successful nan evolving crypto landscape.

Notable Growth and Strategic Shifts successful Insurtech and Payments

The insurtech assemblage successful Singapore knowledgeable a singular finance surge successful nan 2nd half of 2023, pinch a 194 percent summation to US$284.1 cardinal from conscionable US$4.1 cardinal successful nan first half.

This maturation was led by a important early-stage VC information for Bolttech, totaling US$246 million. The assemblage has shifted its attraction towards nan SME market, addressing circumstantial challenges wrong nan security worth chain.

Although nan payments assemblage saw a sizeable driblet successful yearly finance to US$186.13 cardinal successful 2023 from US$984.78 cardinal successful 2022, it maintained a unchangeable woody volume, indicating ongoing liking and nan captious domiciled of this assemblage wrong nan fintech ecosystem.

Caution successful Fintech Investments Through Early 2024

The study suggests that world fintech finance is expected to stay soft into nan first half of 2024, owed to ongoing world conflicts and precocious liking rates.

However, arsenic conditions statesman to stabilise, investments successful AI and B2B solutions are apt to prime up, pinch M&A activity perchance rebounding arsenic investors look toward distressed assets.

Anton Ruddenklau

“The fintech marketplace floundered somewhat successful 2023, buffeted by galore of nan aforesaid issues challenging nan broader finance climate. While location were still bully deals to beryllium had, investors were decidedly sharpening their pencils—enhancing their attraction connected profitability.

While it was a depressed twelvemonth for nan fintech marketplace overall, location were a fewer peculiarly agleam lights. Proptech, ESG fintech, and investors embraced AI-focused fintechs—which helped peculiarly successful nan past six months.”

said Anton Ruddenklau, Global Head Fintech and Innovation, Financial Services, KPMG International.

Get nan hottest Fintech Singapore News erstwhile a period successful your Inbox

5 months ago

5 months ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·