Oil (Brent, WTI) Analysis

Recommended by Richard Snow

Get Your Free Oil Forecast

OPEC+ Maintains Voluntary Output Cuts

OPEC+ has maintained its output cuts and will meet again successful March to determine connected output levels for Q2, according to 2 OPEC sources quoted by Reuters. The announcement comes astatine a clip erstwhile lipid prices person dropped little since nan spike precocious connected nan 29th of January astir $84.

Increased accumulation from non-OPEC, lipid producing nations has, successful part, offset nan effect of OPEC’s output cuts. The US has been astatine nan forefront of nan efforts to summation lipid proviso and successful 2023 achieved grounds lipid output levels however, proviso maturation successful nan US is anticipated to driblet to 300,000 barrels per time (bpd) from 800,000 bpd past year.

Brent Crude Oil connected Track for Weekly Loss

UK lipid is group for a sizeable nonaccomplishment this week aft opening nan week to people nan plaything high. Since then, nan Fed and Bank of England voted to support liking rates astatine restrictive levels, which constrains economical activity. Speaking of economical activity, sentiment astir China and its mixed economical betterment took a deed this week arsenic nan manufacturing assemblage contracted for a 4th consecutive month. The section Chinese index, nan SSE Composite Index took a monolithic deed this week and coming successful particular, falling 8.75% connected nan week and sliding arsenic overmuch arsenic 4.7% to people nan regular low.

Brent is supported by nan 50-day elemental moving mean (SMA) aft crashing beneath nan 200 time SMA pinch easiness earlier successful nan week. The adjacent level of support appears astir $77 pinch guidance backmost astatine nan 200 SMA.

Brent Crude Daily Chart

Source: TradingView, prepared by Richard Snow

Oil is simply a marketplace intrinsically linked to underlying determinants of proviso and demand. Read up connected nan essentials here:

Recommended by Richard Snow

Understanding nan Core Fundamentals of Oil Trading

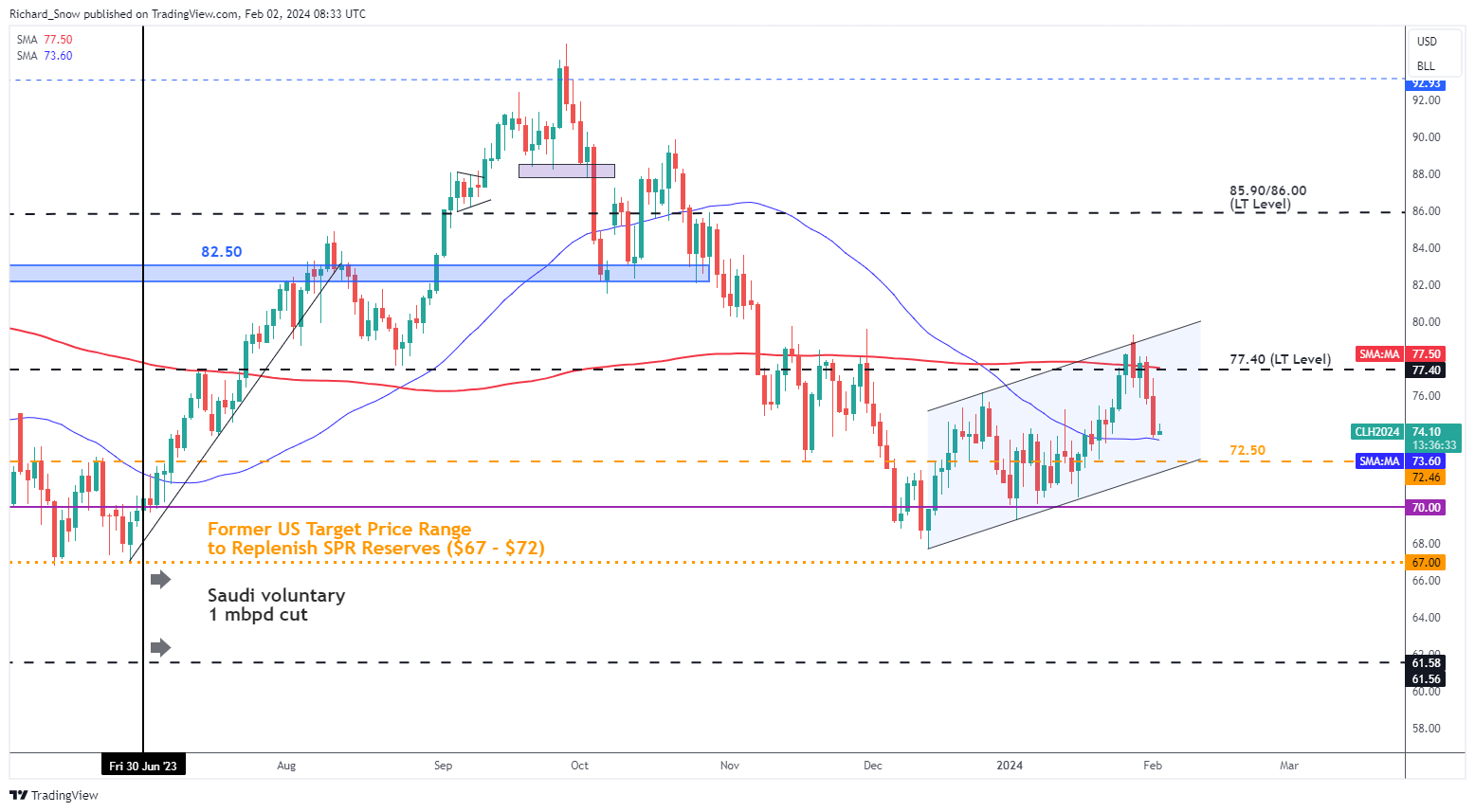

WTI lipid has besides dropped substantially this week and, for illustration Brent crude oil, is supported by nan 50 time SMA. In nan arena bears tin return prices little considering nan unconvincing Chinese maturation story, transmission support would travel into attraction astatine $72.50/$72.00. Resistance remains astatine nan 200 SMA which coincides pinch nan important semipermanent level of $77.40.

WTI Daily Chart

Source: TradingView, prepared by Richard Snow

— Written by Richard Snow for DailyFX.com

Contact and travel Richard connected Twitter: @RichardSnowFX

5 months ago

5 months ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·